excise tax nc formula

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Customarily called excise tax or revenue stamps.

Calculating Excise Tax Youtube

Excise Tax Nc Formula.

. This results in the excise tax that is based. Enter the amounts for the information you reported on Form 56208b in each of the corresponding fields. The excise tax rate is a prescribed dollar amount per unit of a commodity such as 15 cents per gallon of gasoline or a certain percentage of its sales price such as 8 percent of.

1001000 010 counties have the option to levy 030100. Calculating Excise Tax in North CarolinaNorth Carolina Real Estate CourseNeal Pender Instructor. Ad valorem is a latin term that literally means according to value.

North Carolina Department of Revenue. Ad Valorem Excise Taxes. An example of a spirituous.

1 2020 Information Who Must Apply Cig License. In general an excise tax is a tax is imposed on the sale of specific goods or services or on certain uses. For example a 600 transfer tax would be imposed.

Excise Tax Nc Formula. Indirect means the tax is not directly paid by an individual consumer. 1001000 010 counties have the.

The federal tax remains. IRS Tax Tip 2020-133 October 7 2020. An excise tax is an indirect tax charged on the sale of a particular good.

An ad valorem tax is charged by a certain percentage. The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes. This title insurance calculator will also.

Tax liability price of product tax rate quantity. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. If spirituous liquor is sold to a mixed beverage permittee for resale a charge of twenty dollars 2000 per each four liters purchased is included in the price.

Notice 2021-66 provides an initial list of taxable chemical substances. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. 2021 1099 Tax Forms Printable 022022 from.

PO Box 25000 Raleigh NC 27640-0640. Tax liability price of product tax rate quantity. Excise Tax Technical Bulletins.

How can we make this page better for you. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Use this calculator to determine the excise taxes applied to distilled spirits products.

Through December 31 2021 the state excise tax on cigarettes ranges from 0170 per pack in Missouri to 4350 per pack in Connecticut and New York. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. An overview of excise tax.

Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax.

Calculation Of Minimum Cigarette Sale Prices Adapted From Michael J Download Scientific Diagram

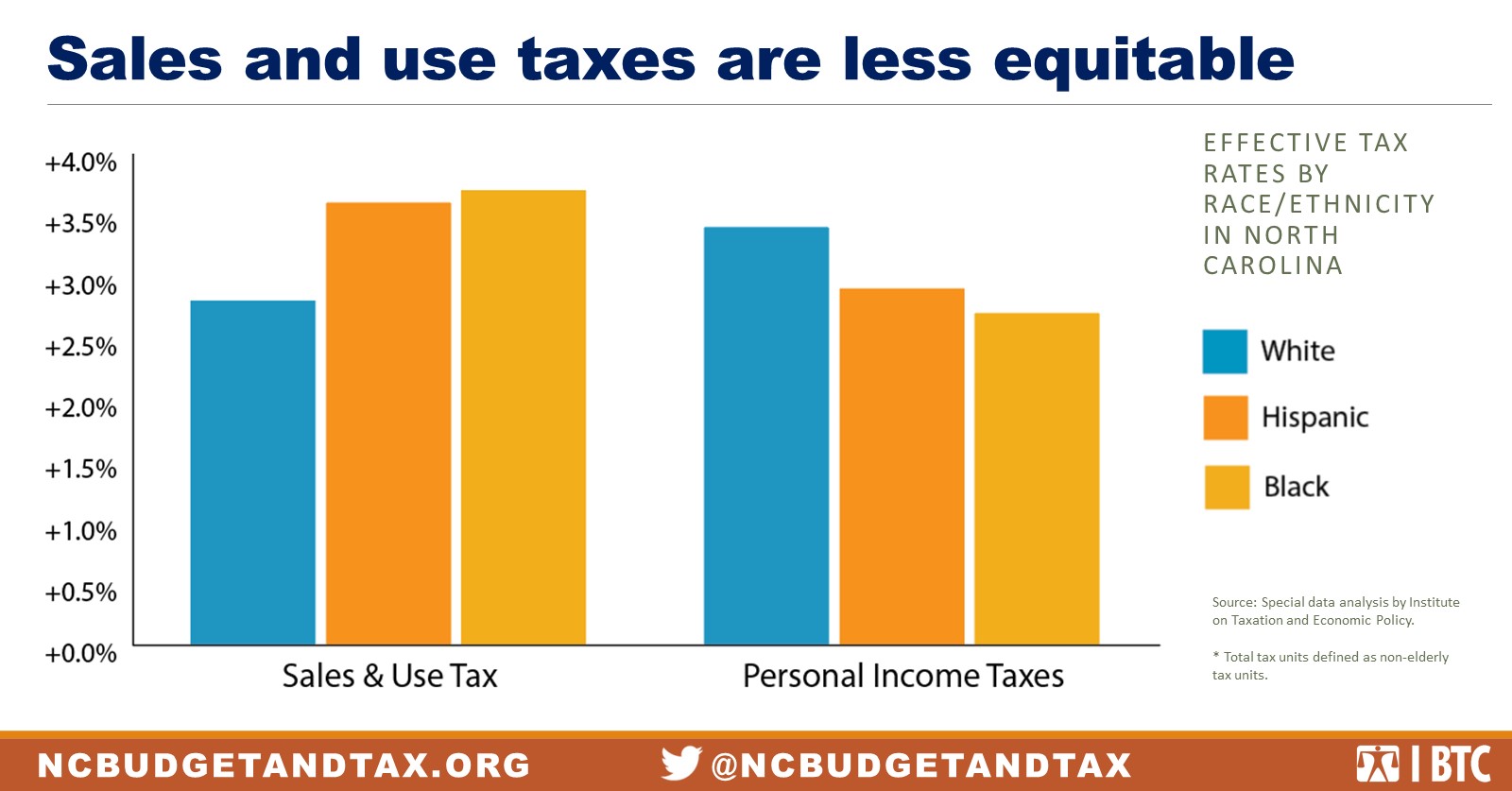

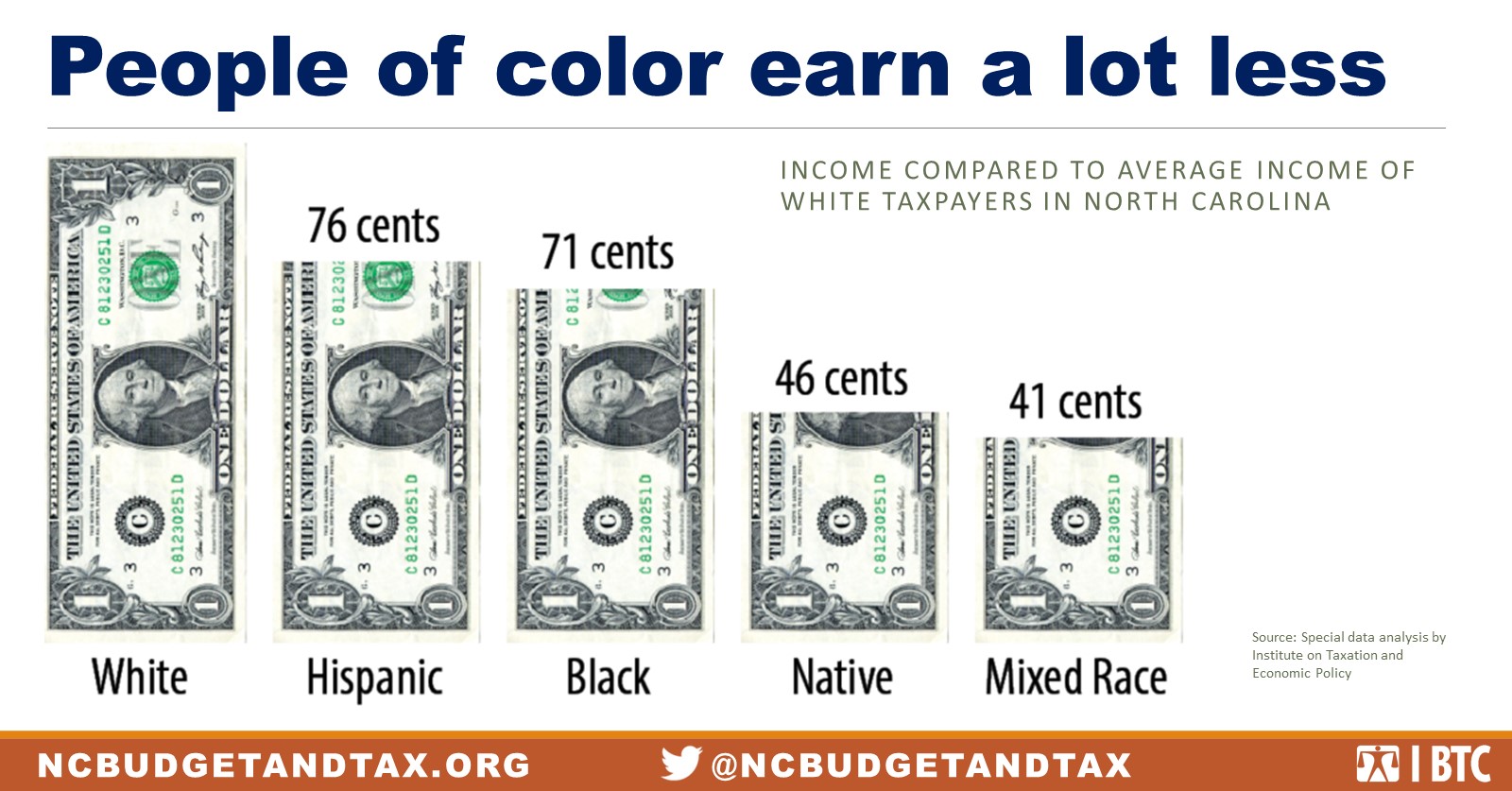

State Tax Policy Is Not Race Neutral North Carolina Justice Center

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculating Excise Tax Help With Closing Statments Youtube

Car Tax By State Usa Manual Car Sales Tax Calculator

Excise Tax Real Estate Exam Prep For North Carolina Youtube

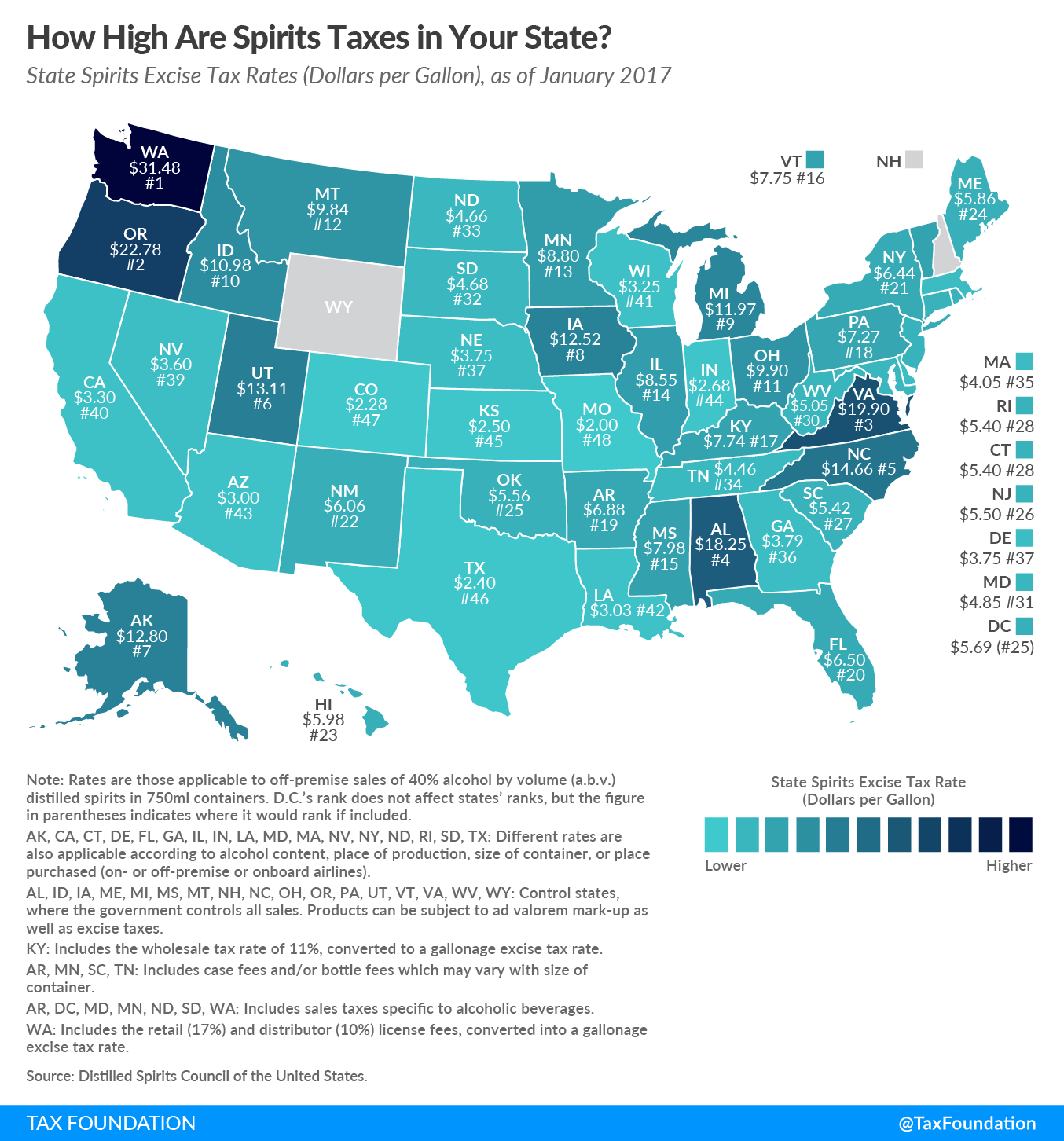

N C Excise Tax On Spirits Nation S Fifth Highest

Calculating Excise Tax Help With Closing Statments Youtube

A Privilege License Is An Excise Tax Levied On The Privilege Of Conducting A Particular Trade Or Business In A County Or City In North Carolina Privilege Ppt Download

Excise Tax Real Estate Exam Prep For North Carolina Youtube

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

State Tax Policy Is Not Race Neutral North Carolina Justice Center

How To Calculate Closing Costs On A Home Real Estate

Car Tax By State Usa Manual Car Sales Tax Calculator

Pdf Excise Tax Calculation For The Eu Member States Third Countries Using Sap Cloud Solution Scp